How Adding a Co-Applicant Improves Property Loan Eligibility

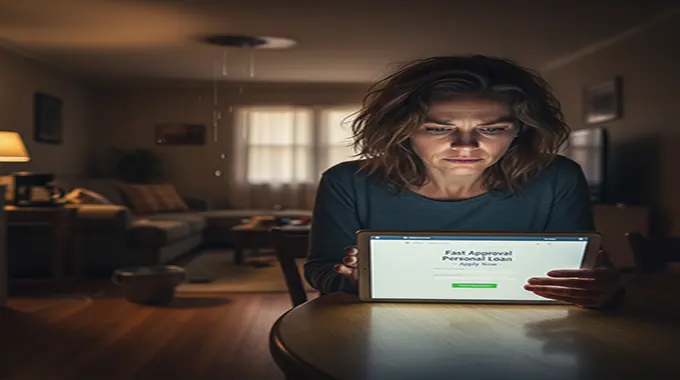

We’ve all experienced this situation: staring at our dream home, getting all excited about it, but then being stopped by the question of loan eligibility. However, here’s an insightful tip: just maybe, a co-applicant will be your winning lottery ticket. Let’s analyze the situation.

Reasons for Bringing a Plus-One to Your Loan Application

You might question, “Why would having someone as a co-applicant result in such a big difference?” It’s basically the same as having one more person to help you carry something that is too heavy. More people means less effort, doesn’t it? Adding a co-applicant can potentially improve your overall financial image which banks crave watching.

Imagine that: by merging your salaries, you give a lender an authentic guarantee that monthly installments will not be a problem. In addition, if your co-applicant maintains his/her credit score reasonably, it will be a nice card thrown in the game.