How Does the Shape of a Part Influence Curing in a Powder Coating Oven

Not all parts are created equal, and their shapes can make or break the powder coating process. From complex geometries to variations in thickness, every contour impacts how heat flows and cures the coating. Understanding these subtle influences can unlock better results, no matter how intricate the parts might be.

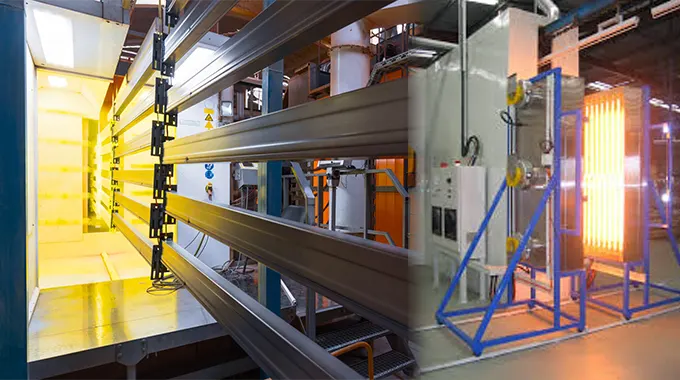

Heat Flow Dynamics Around Irregular Part Shapes

Powder coating ovens work by circulating heated air to evenly cure coatings, but irregularly shaped parts can disrupt this process. Sharp edges, curves, and non-linear surfaces create obstacles for consistent heat flow, causing uneven curing in some cases. These disruptions mean that some areas might overheat while others remain under-cured.

To counteract these challenges, powder coating ovens rely on strategic airflow systems. However, it’s not just the oven’s design that matters; part placement also plays a significant role. When parts with unusual shapes are positioned improperly, it can further block air circulation, …