Building a solid investment foundation: Setting goals and risk tolerance

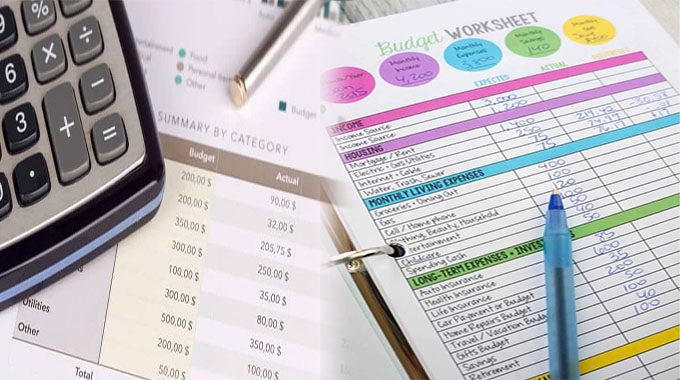

Investing can be a pathway to financial security and wealth building, but it requires a structured approach and a solid foundation. Many people jump into the investment pool with both feet, enticed by the promise of high returns, without assessing their financial situations or end goals. It is crucial to start with two fundamental steps: setting clear investment goals and understanding risk tolerance. Both factors greatly influence investment choices and strategies, making them the bedrock of a substantial investment plan.

This article will explore the role of setting investment goals and determining risk tolerance. Making informed decisions early in these stages can dictate investment success and financial health. We’ll provide insights into how you can define clear investment objectives and assess risk in a way that aligns with your long-term economic aspirations.

By taking a thoughtful approach to these preliminary steps, you can create a personalised investment strategy that reflects …