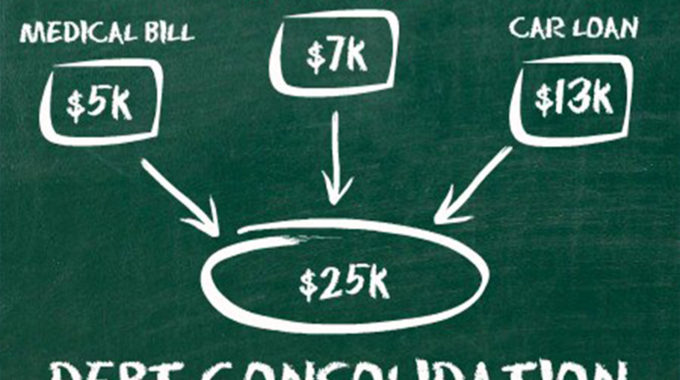

Types of Credit Card Debt Consolidation

There a wide range of firms that are offering to you debt consolidation loan solutions for those who have poor credit. Many consumers have no idea where you should look for help with the economic chaos hitting everyone so hard. If you have poor credit and you are looking for a debt consolidation loan you will discover one. While there are many legitimate companies out there that will help you locate a loan for debt consolidation loan there are a few firms that aren’t legitimate and could worsen your situation. Before you jump in a loan using a company you should take several steps to ensure you don’t end up in a gimmick.

The most important thing that you must know maybe the varieties of loans or services which can be found. Knowing what types of loans and services you will come across may help be sure you pick the …