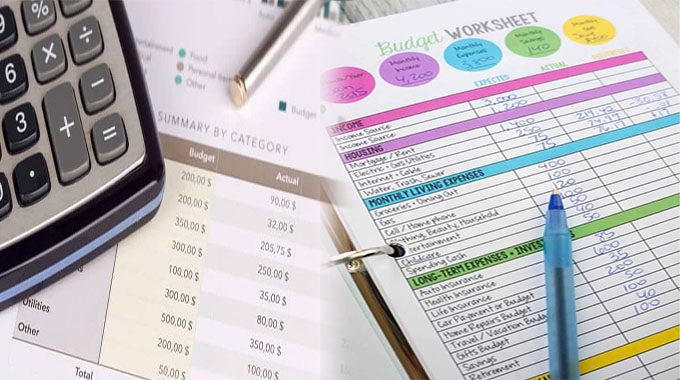

Creating a Family Budget for Monthly Expenses

Managing monthly expenses can sometimes feel like a juggling act, especially when it comes to family finances. But with the right approach, creating a family budget can provide a clear roadmap for financial stability and help alleviate stress about money matters. Here’s how to create a family budget for monthly expenses.

Step 1: Assess Your Income

The first step in creating a family budget is to assess your total monthly income. This includes all sources of income, such as salaries, bonuses, investment dividends, and any other funds that contribute to your household finances. Having a clear understanding of your total income will provide a foundation for budgeting your expenses effectively.

Step 2: List Your Fixed Expenses

Fixed expenses are regular, consistent costs that recur every month. These can include mortgage or rent payments, car loan payments, insurance premiums, and utilities. Make a list of these expenses and their exact amounts …